Its important to have a basic idea of how long you should expect to be retired. There are many rules of thumb out there when it comes to retirement.

How we make money.

How much money do you need to retire at 60 in canada.

In order to live a comfortable retirement you need to ask yourself the following question.

70 if you are typical and do not have a mortgage and up to 100 if you are still paying a hefty mortgage plus other atypical expenses while retired.

By the time you hit 67.

Looking for a retirement calculator.

Another popular notion is that youll need at least 1m to retire comfortably.

For the traditional retire at age 60 or 65 situation the popular advice pushed by the financial industry is to save enough to replace 70 or even 80 of your gross income during working years.

How much money do i need to retire.

By age 64 your retirement nest egg sheltered taxable tax free will have grown to 192938.

While that would be nice most canadians retire comfortably on far less.

Decide when you will retire.

Youll need to make sure you have enough money to support yourself for the entire length of your retirement.

It could save you money.

This calculator shows what interest rate you need to earn to reach a retirement goal.

If someone had the full oas entitlement and received the average cpp 640 a month he or she would need at least 470000 in rrsp savings to generate a net spendable income of 35000 if retiring.

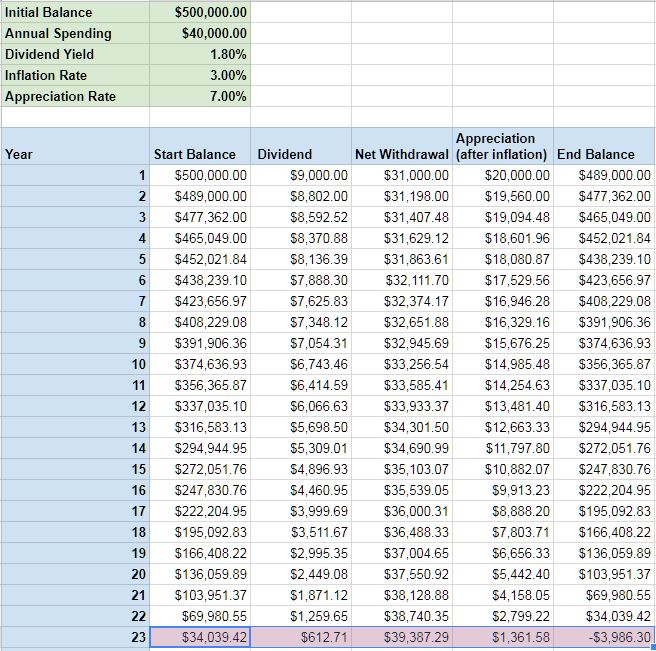

If you have a nest egg of 1 million this means you can safely withdraw about 40000 per year from your retirement accounts.

This rule estimates that you will need between 70 and 100 of your pre retirement income in retirement.

You may have heard that you should be saving 10 15 per cent of your pre tax income or that youll need around 70 per cent of.

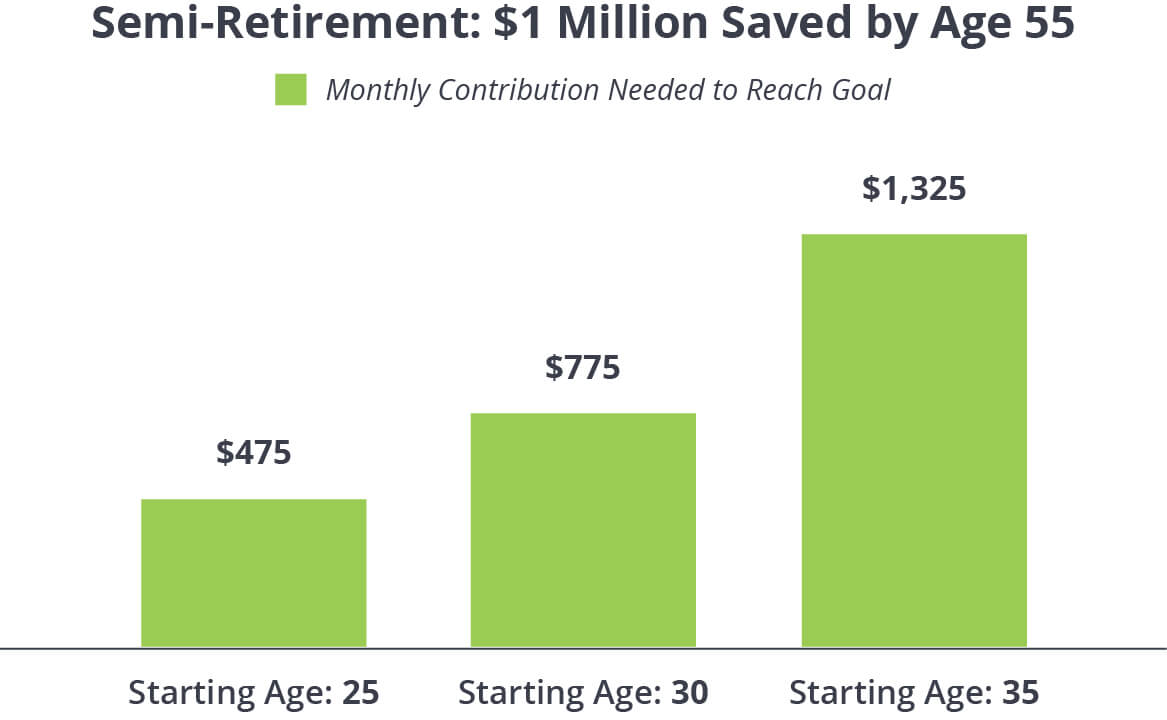

Deciding when youll retire has a big impact on how much you need to save.

Many advisers say you need retirement cash flow equal to 70 to 80 of your peak pre retirement income.

The answer to that question will depend on a number of factors including when you plan to retire and how much you will need to spend during retirement to maintain your desired lifestyle.

As you start withdrawing 45000 40000 and 5000 in todays dollars from taxable and tax free sources respectively your nest egg starts depleting.

No comments:

Post a Comment